Bancamiga is one of the five main banks in the country's financial system, a leader in technological innovation, which is connected online with SENIAT 365 days a year, 24 hours a day.

As from September 15, Special Taxpayers will be able to make their payments to the National Customs and Tax Administration Service (SENIAT), through Bancamiga Online and Bancamiga Suite, as announced by the Chairman of its Board of Directors, Carmelo de Grazia.

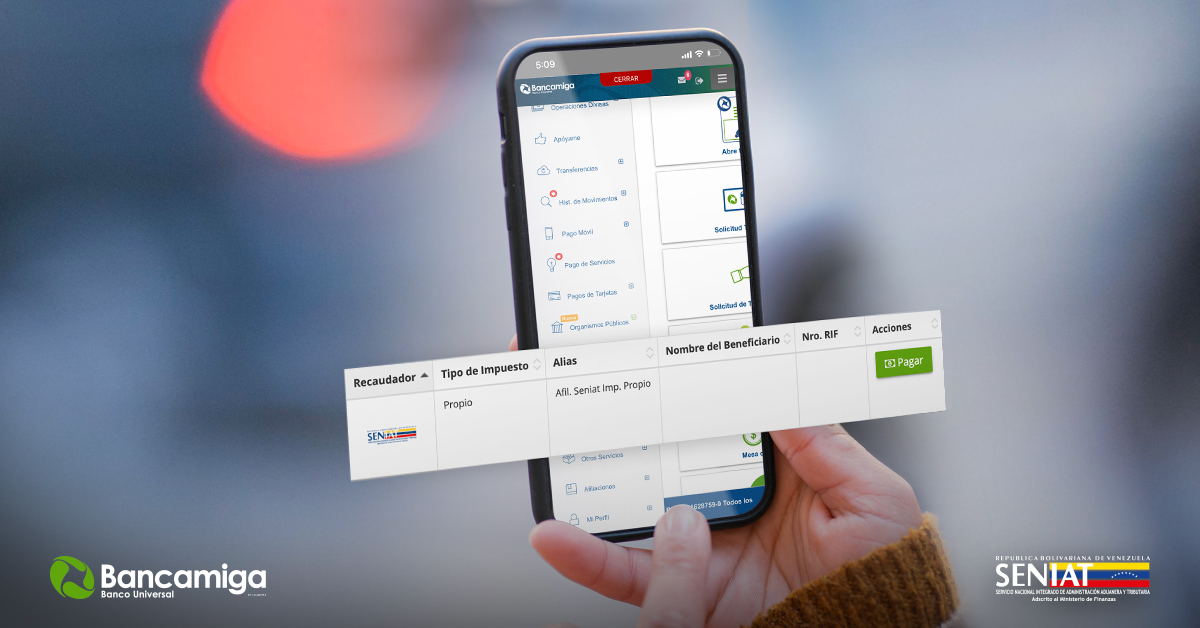

All taxpayers will be able to pay VAT, VAT withholdings, ISLR advances, ISLR, IGTF and any other taxes under SENIAT's control, through Bancamiga Online and Bancamiga Suite 365 days a year, due to Bancamiga's robust technological system which operates 24 hours a day.

Carmelo de Grazia<span lang=”EN-US” style=”font-size:12.0pt”> expressed his satisfaction for the decision taken by the Public Administration that will also allow Special Taxpayers to pay their taxes immediately at any time of the day in an easy, fast and secure way, once they file their returns.

As our technological platform is state-of-the-art, customers can access http://www.bancamiga.como using our "Bancamiga Suite / OnLine Banking" application at any time. Through the Public Bodies/SENIAT option, they pay their taxes or those of third parties. The latter upon authorization in the SENIAT portal.

For Carmelo de Grazia, the fact that most of the time customers prefer to carry out their procedures online benefits the institution considerably, because Bancamiga is a technological bank, which understood some time ago that face-to-face processes generate slowness and make everything more complex.

Bancamiga is one of the five main banks in the country's financial system, a leader in technological innovation, which is connected online with SENIAT 365 days a year, 24 hours a day.

The fact that Bancamiga is a bank with high technological capacity and permanent connection with the SENIAT makes the processes simpler and faster for taxpayers, whether natural or legal persons, giving them a competitive advantage.